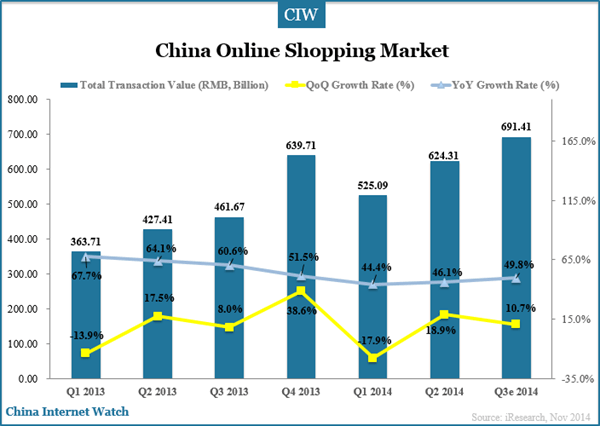

The Chinese e-commerce market have seen a sharp rise in both B2C and C2C channels in the recent years. Rapid development in online shopping platforms, social media, online payment and mobile devices is not only driving the market to a boom, but also revolutionizing consumer experience and business marketing methods. Here are the four major new trends to be observed in the industry.

NO. 1: Mobile Devices – Shopping On The Go

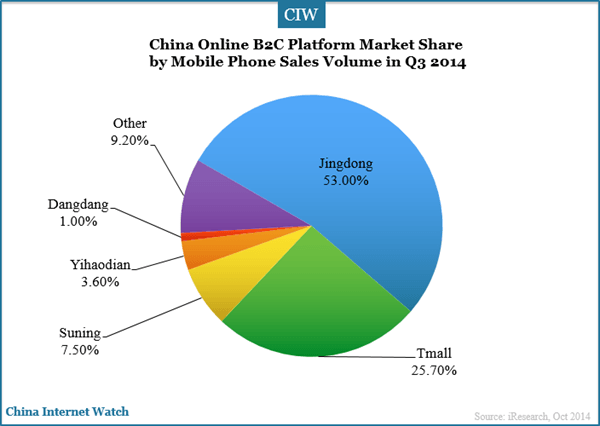

As mobile devices such as smartphones and tablets penetrate further into the market, Chinese online shoppers are increasingly making their purchases on the move. A survey published jointly by KPMG and Mogujie shows that although desktops and laptops remain the most used devices for online shopping, smartphones and tablets are swiftly taking over.

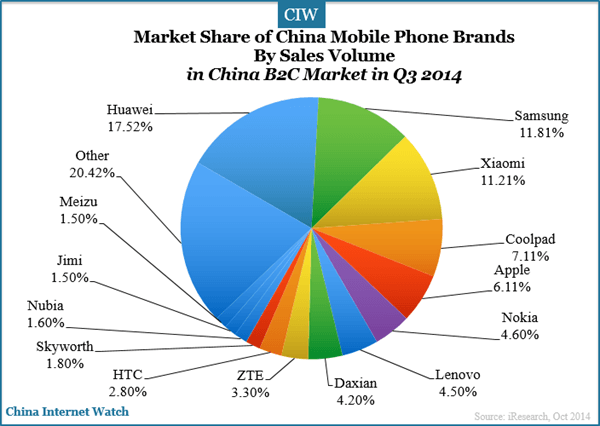

The large 3G/4G network user base will give mobile shopping even greater potential. The number of Chinese 3G/4G users rose from 223 million to 325 million in merely six months in the first half of 2013. And the Chinese government has a even greater vision for the future: the goal is to see the number of mobile network users increase to 1.2 billion by 2020.

NO. 2: Mobile Payment – A Revolution in Payment Methods

Another prominent trend in Chinese e-commerce market is that online shoppers in China are rapidly taking up mobile payment. The survey shows that as much as 55% of online shoppers in China has used mobile payment for their online purchases, whereas in the U.S. the figure is only 19%. This transition is largely facilitated by the recent developments in domestic third-party payment service market, which is currently dominated by four key players – Alipay, Tenpay, Union Pay and 99bill. Together, these four channels provide 85.5% of payment services in China.

NO. 3: Readjustments in Product Positioning Strategies in Line with Consumer Needs

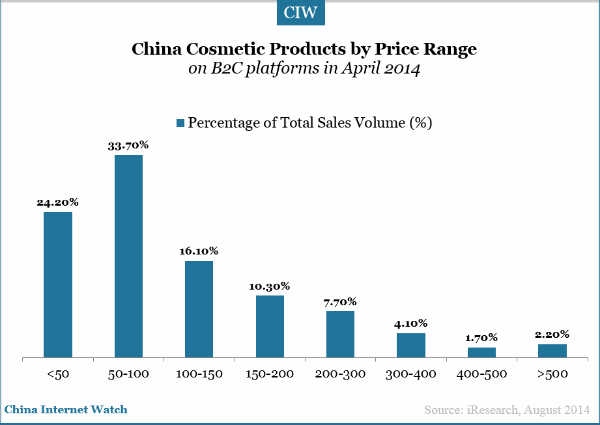

As the e-commerce industry grows, the motives and concerns for Chinese consumers’ online shopping behavior become all the more clear. The KPMG research shows that the most important factor that influences consumers’ decision to make a purchase online is still the price – as much as 74% of respondents name low price as their major consideration when shopping online. “Online purchasing in China is still mostly promotional and discount driven. This means we are at the infancy stage… imagine the potential of full-price e-commerce.” explained Thibault Villet, CEO & co-founder of Glamour Sales. Other conveniences driving shoppers to go online include less time consumption, specific origin of products, the possibility to compare goods and a larger variety to choose from.

In the mean time, some major drawbacks of online shopping remain striking. 78% of respondents of KPMG survey report concerns over the authenticity of products sold online. Also, most consumers wish to try the product before purchase, an expectation still largely unmet by online businesses. Apart from that, size, discrepancy between online display and actual product and after-sales services also remain as major concerns for online shoppers.

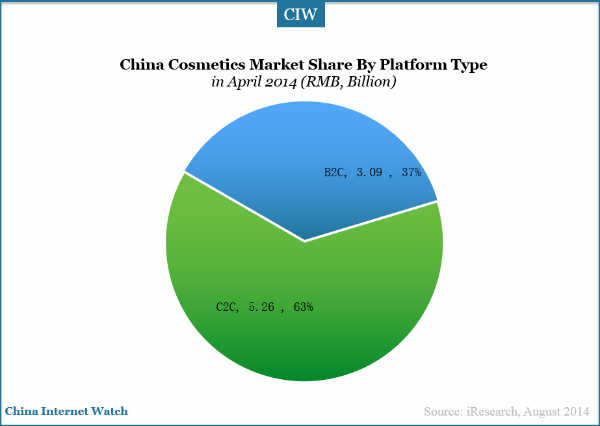

Consumers’ needs are certainly catalyzing continuous readjustments in product positioning strategies on the retailers’ part. The most popular products sold online should also serve as an important indicator of the e-commerce market. The survey indicates that cosmetics, shoes and apparels for female are the top categories shopped online nowadays. These particular categories of product sought after by online shoppers indicate an enormous potential for luxury brands as Chinese consumers gain more purchase power and become less price-sensitive.

NO. 4: Social Media as a Powerful Marketing Tool

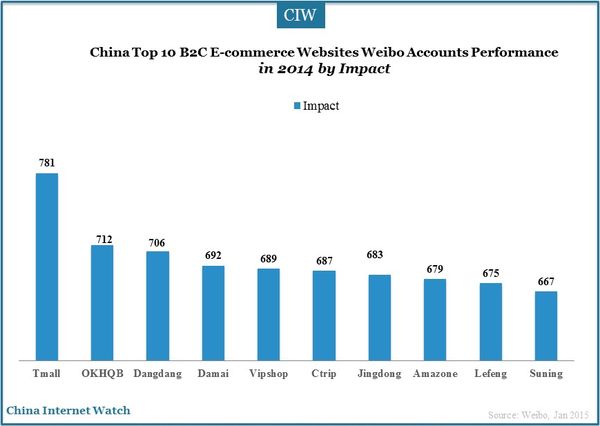

The most immediate change in the e-commerce industry which no online business can overlook is perhaps the burgeoning marketing power of social media. Research shows as much as 25% of traffic in e-commerce websites is brought in by social media, among which half can be attributed to the voices of popular online opinion leaders. With a range of successful local social media and a growing user base, Chinese shoppers are increasingly resorting to user reviews online as references when they make a purchase. This channel has even overtaken the traditional WOM (word-of-mouth) communication by 1%, a testimony of its fledging power.

As said before, the e-commerce market has a tendency of slanting towards certain categories of products that can be readily transformed into large luxury market. For this reason, retailers are propelled to give more attention to luxury product marketing on social media. Indeed, the top social media platforms are already playing an important marketing role in the Chinese luxury market.